- Selling property

- Leasing

- Inventory

- Compensation and bonus practices

- Depreciation and expense elections.

Cash Basis Small Businesses

Generally, a cash-basis taxpayer recognizes income when received and takes deductions when paid. Here are some more rules for cash basis taxpayers:

- Income is generally taxable in the year received, by cash or check or direct deposit. You cannot postpone tax on income by refusing payment until the following year once you have the right to that payment in the current year. (This is the so-called the “constructive receipt” rule.) Therefore, businesses using the cash basis method of accounting recognize and report income when the business actually or constructively receives cash or something equivalent to cash.

- However, if you make deferred payments a part of the overall transaction, you may legitimately postpone both the income and the tax into the year or years in which payment occurs. Examples include:

- Installment sales, on which gain is prorated and taxed based upon the years over which installment payments occur

- Like-kind exchanges through which no gain occurs except to the extent other non-like-kind property (including cash) may change hands

- Tax-free corporate reorganizations under Section 368 of the Internal Revenue Code.

- Deductions, however, are generally not allowed until you pay for the item or service for which you want to take the deduction. Merely accepting the liability to pay for a deductible item does not make it deductible. Therefore, a supply bill does not become deductible in the year that the bill is sent for payment. Rather, it is only considered deductible in the year in which you pay the bill.

- Determining when you pay your bills for tax purposes also has its nuances. A bill may be paid when cash is tendered; when a credit card is charged; or when a check is put in the mail (even if delivered in due course a few days into a new calendar year).

Cash basis businesses that expect to be in a higher tax bracket in 2014 should shift income into 2013 by accelerating cash collections this year, and deferring the payment of deductible expenses until next year, where possible. In this situation, small businesses should try to collect outstanding accounts receivables before the end of 2013.

Accrual Basis Small Businesses

Basically, for accrual-basis taxpayers, generally the right to receive income, rather than actual receipt, determines the year of inclusion of income. Accrual method businesses that anticipate being in higher rate brackets next year may want to accelerate shipment of products or provision of services into 2013 so that your business’s right to the income arises this year.

Taking the opposite approach: If you will be in a lower tax bracket next year, an accrual basis taxpayer would delay delivering services or shipping products.

2. Tax Break For Small Business Expense Election Under Section 179

ATRA extended until the end of 2013 the enhanced Code Sec. 179 small business expense. Small businesses that purchase qualifying property can immediately expense up to $500,000 this year. This amount is reduced dollar for dollar to the extent of the cost of the qualifying property placed in service during the year exceeds $2 million. If you plan to buy property (even computer software qualifies), consider doing so before year-end to take advantage of the immediate tax write-off.

Warning: Remember that any asset must meet the “placed in service” requirements as well as being purchased before year-end.

Also included as qualified Code Sec. 179 property (only temporarily though) is “qualified” real property, which includes qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property. However, businesses are limited to an immediate write-off of up to $250,000 of the total cost of these properties.

Note, the Section 179 expense limit goes down to $25,000 and the phaseout threshold kicks in at $200,000 starting in 2014. Also the qualified leasehold-improvement breaks end at the end of 2013. If you are planning major asset purchases or property improvements over time, you may want to take advantage of this break before year-end.

Final note: In addition to new property, Section 179 can be applied to used property.

3. Bonus deprecation

ATRA extended this additional first year depreciation allowance into 2013. This bonus depreciation allows taxpayers to immediately deduct fifty percent (50%) of the cost of qualifying property purchased and placed in service in 2013. Qualifying property must be purchased and placed into service on or before December 31, 2013.

Qualifying property must be new tangible property (refurbished assets do not qualify) with a recovery period of 20 years or less, such as office furniture, equipment and company vehicles, off the shelf computer software and qualified leasehold improvements.

Note that bonus depreciation is not subject to any asset purchase limit like Section 179 property.

4. Accelerated Depreciation

ATRA has retained through 2013 the tax break that allows a shortened 15 year recovery period for qualified leasehold improvements, restaurant and retail improvement property. Normally the recovery period for this type of property is 39 years so this is a huge tax break.

5. Increased start-up expense deduction

New businesses can take advantage of the increased deduction for start-up expenditures. This start-up expense deduction limit is $10,000. The phaseout threshold is $60,000. Thus, if you have incurred during 2013 start-up costs to create an active trade or business, or the investigation of the creation or acquisition of an active trade or business, you may benefit from this increased deduction. Entrepreneurs can recover more small business start-up expenses up-front, thereby increasing cash flow and providing other benefits.

6. Repair Regulations

The so-called “repair” regulations include a valuable de minimis rule, which could enable taxpayers to expense otherwise capitalized tangible property. Qualified taxpayers may claim a current deduction for the cost of acquiring items of relatively low-cost property, including materials and supplies, if specific requirements are met.

The IRS with their issuance of final regulations relaxed many of the requirements contained in the earlier temporary regulations. For example, the final regulations removed the ceiling requirements on deductions and now allows the de minimis rule for businesses that do not generate financial statement (applicable financial statements (AFS)). This allows many small businesses to take advantage of these tax breaks.

The modified safe harbor allows businesses without an AFS to immediately deduct up to $500 or less (or $5,000 or less for taxpayers with an AFS) for qualified property purchases. For example, a business could deduct hundreds of lap-top computers or scanners costing $500 or less each year.

Bottom Line: The modified safe harbor may be easier for certain small businesses than the Section 179 deduction and 100% bonus depreciation. Most importantly, the regulations now allow taxpayers that do not prepare financial statements to use de minimis safe harbor. This provides a great benefit for many small businesses that do not normally generate these statements as part of their regular business operations.

7. Compensation arrangements

Timing of Compensation:

In a regular C corporation, compensation paid to employees reduces the taxable income of such corporation. Ideally, compensation should be used to eliminate taxable income at the corporate level or at least minimize such income. It is imperative that the total compensation paid is “reasonable” in light of the services performed and industry norms. For more insights into the reasonable compensation issue please read Reasonable Compensation:A Favorite Issue For IRS Auditors.

Use of Retirement Plans:

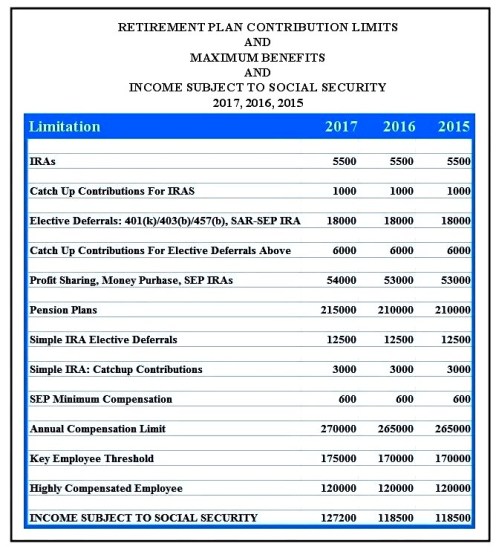

Corporate retirement plans such as profit sharing, money purchase pension, and defined benefit plans can generate large tax deductions for the entity. These plans are quite useful when compensation has already reached the highest level of reasonableness.

Important Points:

- These corporate retirement plans must be drafted and signed before year-end to get tax deductions for that year.

- These plans can generate a deduction even though the plan is not funded until after year-end, so long as funded by the due date (or the extended due date) of the corporate or entity return. This gives the small business owner some after the taxable year-end planning flexibility.

- For profit sharing, money purchase pension and other defined contribution plans, an employer can contribute up to $51,000 per participant. For participants age 50 and older this amount can be $56,500 because of the catch-up contribution rules.

- For defined benefit plans, the plan retirement amount and funding are determined by various actuarial computations. The maximum future benefit can be $205,000 per year upon retirement. Depending on the age of a participant this can result in a very large contribution each year and one far in excess of the amounts available under the defined contribution plans discussed immediately above.

- There are various limits and rules specific to each of these plans and the particular make-up of the employees and their ages bear heavily in the proper choice of plan and the design of any plan chosen.

Additionally, and maybe more importantly, when compensation paid to owners is approaching their own:

additional taxes can be saved by making contributions to such plans instead of paying more compensation to the owner. This can produce a double benefit: huge income tax savings and having money being put into a retirement plan to grow tax-free for the benefit of the small business owner.

Use of 2 ½ Month Bonus Rule:

Particularly relevant to employers at year-end is an annual bonus rule. Bonuses paid within a brief period after the end of the employer’s tax year are deductible in that tax year. Compensation is generally considered paid within a brief period of time if it is paid within two and one-half months of the end of the employer’s tax year.

Compensation and K-1 Distributions

Compensation and shareholder or partner distributions from a business, and drawing the often fine line between the two, can make a significant difference to a business owner’s overall tax liability for the year. For example, for an S corporation, payment of salaries are subject to social security taxes while K-1 income is not subject to this tax. The strategy here would be to pay less in salary and have more income reported on the Form K-1. However, taxpayers can be in trouble here if they get greedy. The IRS is policing this area to make sure that the salary paid is reasonable. Therefore, a reasonable salary must be carefully determined and supportable in a tax audit.

Deferring payments of accrued bonuses

In certain situations, it may be preferable to simply ask that your employer pay your bonus in the following year where you expect that your tax bracket will be lower.

Here are a number of other year-end tax planning strategies you may want to consider, depending on your particular tax and business situation:

- Accelerating installment sale proceeds or electing out of the installment method;

- Elect slower depreciation methods;

- Determine if you can write-off any bad debts;

- Consider changing your accounting method to advance income or defer expenses. This one needs careful consideration, however, as accounting method changes can have a binding effect on taxpayers for many future years;

- Determining the difference between ordinary business activities and passive activities before implementing a year-end strategy also makes good sense. Rental income or losses, and other passive activity gains and losses, must be netted separately from business gains and losses. Year-end timing for one does not necessarily help control your bottom-line tax cost on the other;

- Cost Segregation Study: For those who have purchased, constructed or rehabilitated a building this year, a cost segregation workup may save taxes. It identifies property components and related costs that can be depreciated faster than the building itself, generating larger deductions. For example, breaking out costs for fixtures, security equipment, landscaping and parking lots may generate larger tax deductions. Be careful to take into account the impact of the alternative minimum tax and to consider states that do not follow the federal tax rules.

Final Thoughts:

The above are not intended as a comprehensive list of year-end tax planning tools for small businesses. The point here is that each business has its own unique tax and business situation. A case by case analysis to determine which tax planning tools will minimize taxes is the best course of action for small businesses.

If I have missed something or if there is a strategy you want me to explore or explain more fully, please leave a comment below. I would be glad to help.

For an analysis of what deferral or acceleration planning at year-end may work best for you and your business, please do not hesitate to contact me.

Disclosure and Disclaimer: As required by United States Treasury Regulations, you should be aware that this communication is not intended by the sender to be used, and it cannot be used, for the purpose of avoiding penalties under United States federal tax laws. This article has been prepared and published for informational purposes only and is not offered, nor should be construed, as legal advice. For more information, please see the firm’s full disclaimer.

The Internal Revenue Service announced on December 1, 2016 (IR-2016-155) the launch of an online application that will assist taxpayers with straightforward balance inquiries in a safe, easy and convenient way.

The Internal Revenue Service announced on December 1, 2016 (IR-2016-155) the launch of an online application that will assist taxpayers with straightforward balance inquiries in a safe, easy and convenient way.

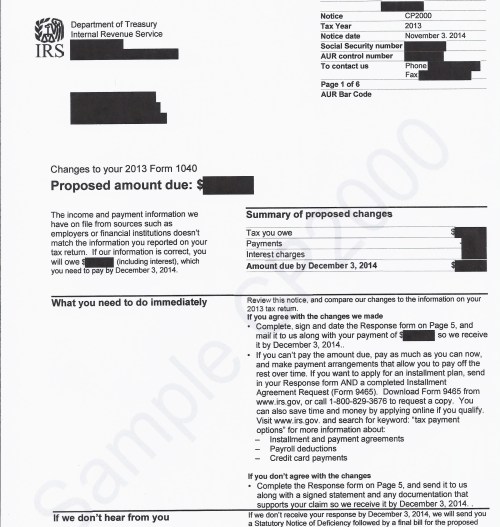

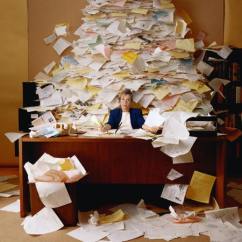

Each year, the IRS mails millions of notices and letters to taxpayers for a variety of reasons. This can be extremely upsetting when receiving this form of communication, whether it is from the IRS or any other taxing authority. The following tips are presented to reduce your anxiety and to provide a specific action plan for any correspondence received from the IRS (or from your state or local taxing authority):

Each year, the IRS mails millions of notices and letters to taxpayers for a variety of reasons. This can be extremely upsetting when receiving this form of communication, whether it is from the IRS or any other taxing authority. The following tips are presented to reduce your anxiety and to provide a specific action plan for any correspondence received from the IRS (or from your state or local taxing authority): The Internal Revenue Service on December 18, 2015 issued the 2016 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

The Internal Revenue Service on December 18, 2015 issued the 2016 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

In our fast paced world, many retirement plans are drafted and then often neglected. In extreme cases, plans are put aside without ever being updated. Some plan sponsors have failed to restate their plans for years or even decades. For many individuals, retirement plan accounts represent the largest portion of their wealth. As the following discussion will illustrate, the failure to protect this most valuable and important asset by keeping the retirement plan in full compliance with applicable retirement plan laws could result in some very nasty, costly and unforeseen financial repercussions.

In our fast paced world, many retirement plans are drafted and then often neglected. In extreme cases, plans are put aside without ever being updated. Some plan sponsors have failed to restate their plans for years or even decades. For many individuals, retirement plan accounts represent the largest portion of their wealth. As the following discussion will illustrate, the failure to protect this most valuable and important asset by keeping the retirement plan in full compliance with applicable retirement plan laws could result in some very nasty, costly and unforeseen financial repercussions.